12 Factors Banks Consider before Approving Home Loan in India

Home is where your heart is. Home is where love resides, memories are created, and laughter never ends. A home is built of love and dreams. As they say, “home is not a place; it’s a feeling.” Everyone dreams of having a home which they can call their own.

Some people get it easy when they inherit a residential property from their family. However, there are some who must sweat it out to be able to own a home. Buying a home is a popular investment choice too. However, a lot of budgeting, planning, focus, and sacrifice goes into owning one.

Most people achieve their ‘dream of owning a home’ through “Home Loans.” Getting a Home Loan in India is not an easy task. This is where DHFL Home Loan comes to your help. Dewan Housing Finance Corporation or DHFL, as it is commonly known, is the prime housing finance company with a focus on providing Home Loans to lower- and middle-income groups. It offers financial solutions to achieve your home dream and aims to build a nation of proud homeowners. There are several factors that impact your chances of Getting a Home Loan in India. Let’s take a quick look at the Top 12 factors that banks consider before approving your application.

Tip: Best Home Loan for Salaried Person before applying for a loan

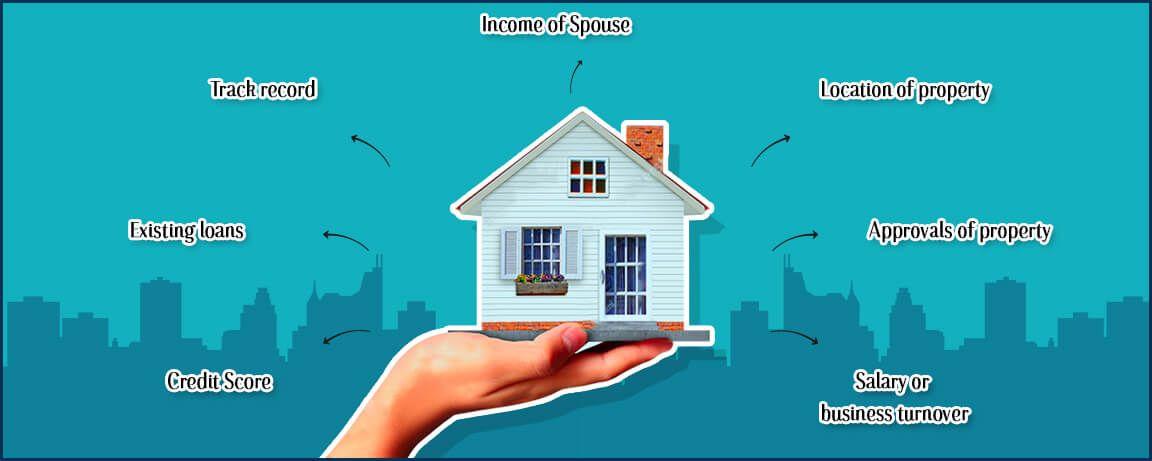

Factors to Consider Before Getting a Home Loan Approval in India

1. Credit Score:

Your credit score is a major deciding factor for Home Loan approval. Credit Score is a numerical rating that determines how well you can repay your debt. It is a score of your financial health. In simple words, it shows how good you have been with the repayment of your previous debts and credit card payments. Financial institutions prefer to give loans to individuals with a clean Credit History. A good credit score will help you get the loan approval faster. A credit score of 750 and above is considered an excellent score for availing a loan, while anything between 700 and 600 is considered good.

2. Existing loans:

Your overall Home Loan Eligibility will come down if you already have existing loans and are paying EMI. Financial institutions prefer individuals with no pre-existing loans as it means that you are financially more stable with no pre-existing liabilities.

3. Age:

Age is an important factor that financial institutions consider while giving Approval for Home Loan. Individuals in the age bracket of 30-50 years are the best candidates for getting a loan as they have a decent number of working years left for repayment of the loan.

4. Track record:

Financial institutions look for stability while granting approval for Home Loan. A person who keeps on changing jobs gives a negative impression. Financial institutions prefer individuals who have been working in a company for at least 3 years. The longer you have been with a company, the better are your chances of getting a loan.

A financial institution will hesitate to give loans to individuals working in companies with a questionable track record.

5. Occupation:

Occupation is a major factor for consideration while appraising your home loan. Individuals with stable jobs and a fixed income are given preference. Employees in PSU and government jobs are preferred because of the stability of their jobs. Doctors and individuals working in blue chip companies are second preference followed by Lawyers, Engineers, and Chartered Accountants. Financial institutions are wary of granting a loan to self-employed individuals and contractors who do not have a regular source of income.

Additional Info: Also check Rs. 1 Crore Home Loan EMI

6. Salary or business turnover:

Your current salary and your estimated salary in coming years are important deciding factors in availing a Home Loan. Your loan repaying capacity is directly proportional to your salary. Individuals in a lower salary bracket are more financially stretched out and can be at risk of being defaulters. This makes them high-risk applicants compared to individuals in a higher salary bracket.

7. Income of Spouse:

Depending upon the income of your spouse, you can Apply for a Joint Home Loan. This increases your loan eligibility as your joint income will be considered for repayment of the loan. If your Home Loan gets approved in your wife’s name, then you can get it five basis points below the normal Home Loan rate.

8. Relationship with the financial institution:

The older your association with the bank or financial institution, the higher are the chances of getting your loan approved. A steady relationship guarantees consistency and trust between the lender and the borrower.

9. Location of property:

Location of the property is an important factor that decides the appraisal of your loan. The financial institution assesses the marketability of the property before approving the Home Loan. The more saleable a property is, the easier it is to get it financed. Conveniently located properties with proximity to schools, shopping plazas, train stations, and hospitals are more likely to get financed compared to properties that are remotely located.

10. Approvals of property:

A financial institution will evaluate the property that is being offered against the loan. Any property embroiled in legal issues or for which the reputation of the builder is at stake presents a risk to the financial institution. This may translate to stricter lending conditions for the buyer.

11. Down payment:

A sizeable down payment will always work in your favour. Usually, financial institutions prefer a 20% down payment. However, the more, the merrier as it gives financial institution confidence about your credibility.

12. Surplus income:

Surplus income is what you are left with after paying taxes and other liabilities. Individuals with surplus income are considered financially healthy and have a better capacity to repay the loan.

These are some of the factors on the basis of which a Home Loan application is approved in India. If you are well aware of these factors, you stand a better chance of a faster approval and disbursal of Home Loan.

Also Read: Claim Tax Deduction Up To Rs. 2 Lakhs on Home Loan in India

To apply online for Best Home Loan for Pensioners, Credit Cards, Secured Loans and Unsecured Loans, visit www.mymoneymantra.com, the leading online lending marketplace that offers financial products from 100+ Banks and NBFCs. We have served 5 million+ happy customers since 1989.