How Can Using an EMI Calculator Be Helpful When Applying for a Loan?

In India, a large number of people take Home Loans, Personal Loans and Loans Against Property, from banking and non-banking financial companies (NBFCs) to fulfil their needs and realise their dreams. In order to complement this vision, a large number of online lenders offer lucrative interest rates and equated monthly instalment (EMI) alternatives.

EMI

EMI is essentially an abbreviation for Equated Monthly Instalment. It is a fixed amount of payment including both, the principal loan amount as well as applicable interest that a borrower has to make to the lender at monthly intervals. The EMI is a meticulously calculated figure, which is agreed to by both parties involved. Repayment of a loan through EMIs is a continuous process which lasts the entire period of that loan until the whole amount, along with interest is paid off. Here, it is essential for one to understand that as the loan period advances and the principal amount reduces, the interest decreases.

Given that a vast majority of loans involve a hefty sum of money, it is of paramount importance for the borrower to undertake due diligence before applying for a loan. Over the last few years, several online avenues have opened up for the benefit of a prospective borrower wherein he can leverage the internet apply for a personal loan or home loan. One of the fundamental aspects of this due diligence is to calculate the monthly EMI.

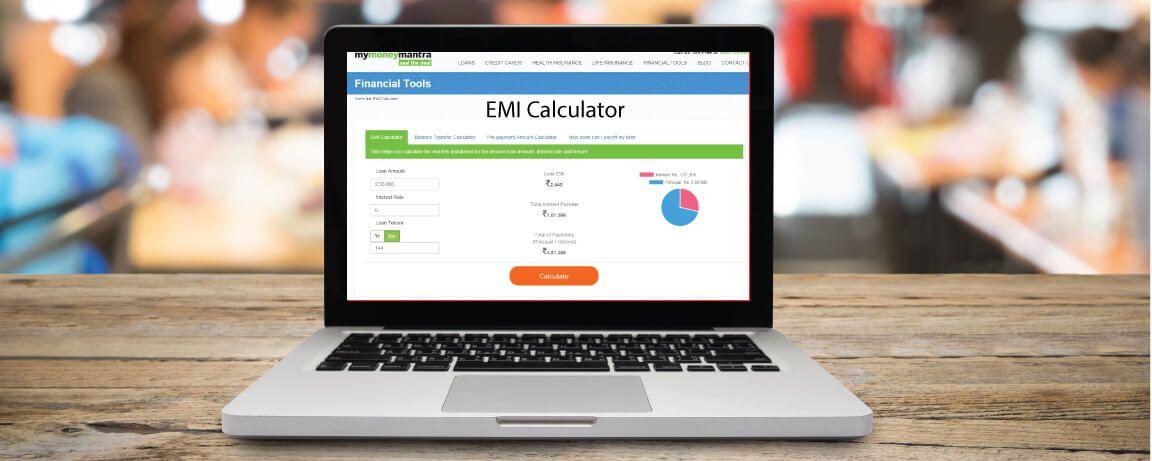

Loan EMI Calculator: How does it Work?

In very basic terms, an EMI calculator acts as an instrument which utilises the following essential components to help you calculate the EMI that you will be required to pay.

- Total amount to be borrowed

- The entire duration of the loan

- Applicable interest rates

- The processing fee levied by the financial institution.

The parameters as mentioned above are fed to an algorithm, and it does the rest.

An EMI calculator is not a conventional calculating device. It can help you in more than one ways, some of which are mentioned below –

1. It Accounts For Planned Prepayments

Some calculators can take into considerations specifically projected pre-payments that you plan on making towards your loan. Hence, a detailed break up will necessarily include the amount borrowed, the interest payable, the processing fee and the fee for prepayment, along with the amount you will pay through prepayment.

2. It is Always Available

The time has gone when one needs to make laborious calculations to finalise on the most appropriate loan proposal.

You can take the help of our easy to use EMI Calculator that gives accurate details about your EMIs. You will thus be in a position to understand the intricacies of your loan repayment in a matter of seconds.

3. It Offers 100% Accuracy & Instant Calculations

An electronic calculator has been one of the greatest inventions by financial institutions. All you need to do is to enter the correct numbers and symbols, and you are good to go. With the complexities involved in calculating an EMI manually, there is some scope of error. It is at this point that our EMI Calculator can come to the rescue. With this specialised software, all you need to do is fill in a few parameters and all your worries about having entered the wrong formula or missing the decimal can be tossed out. Of course, it also saves you from the hassle of checking and rechecking your calculations a million times.

4. It Avails Graphical Interpretations

An EMI Calculator does a great job at pictorially and graphically representing every single parameter concerning your loan right from principal outstanding, and time remaining to the rate of interest and the amount of interest! These representations make it easier for you to take an informed decision.

5. It Offers a Comprehensive Amortisation Table

An online EMI calculator is equipped to show you the progress of your loan over the period, through an amortisation table. This table represents the periodic repayment schedule of your loan, along with your EMIs, the interest payments, as well as the outstanding dues after each EMI payment.

EMI calculators are becoming more and more integral to the process of loan application. After all, acquiring a loan for your dream home or your entrepreneurial venture need not be a tedious task.

Now that you are fully aware of this revolutionary tool go ahead and start your hunt for a loan that will bring a change in your life, for good!