How to Invest in Mutual Funds in India?

Investing in mutual funds can be the best option for most people in today's scenario. For first-time investors, investing in mutual funds can be tricky at times. However, with proper information and details, it can be considered one of the most feasible options for people to invest in 2023.

The fact that mutual funds come with a low-cost policy makes it feasible for most country residents to invest in them instead of other fixed deposit options in India.

If you are considering investing in mutual funds in 2023 in India, here is everything you may need to know regarding how to invest in mutual funds.

Additional Info: You can Know About Navi Mutual Fund

How Does Mutual Funds Work?

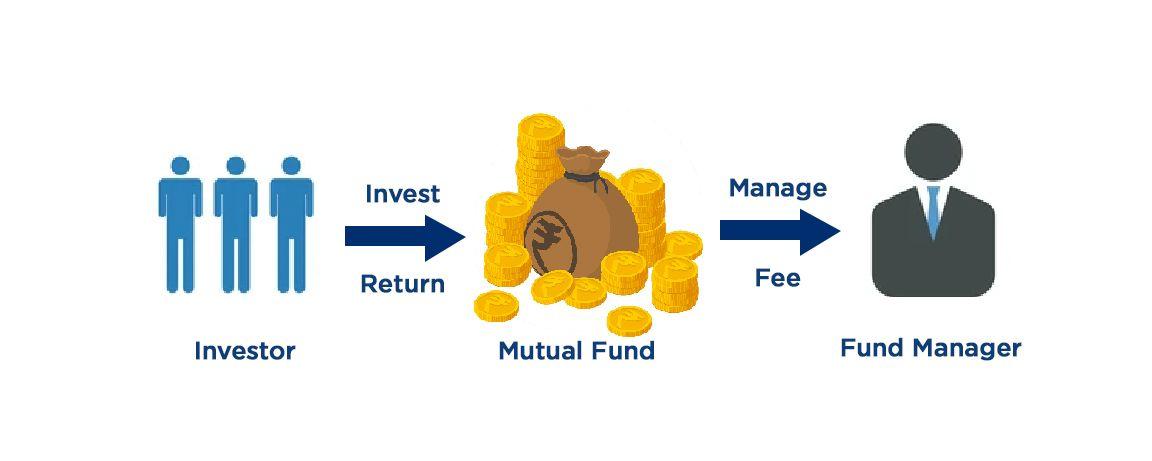

When an AMC or Asset Management Company pools investments by collecting money from several institutions, micro-lenders, and other individual investors with common goals, a mutual fund is formed.

A manager is appointed to take care of all the investment strategies and other details regarding important investments in the company. The manager is supposed to generate maximum returns for the amount of investments taking place inside the company.

Experts with highly influential past experiences in this field are appointed as fund managers who conduct in-depth research to look after the expense ratio, returns, fee management, and other details.

Investors tend to make money when interests are generated from the customers' money. They can choose to reinvest the capital gains or on a monetary income by the procedure.

How to Invest in Mutual Funds Online?

There are several ways that you can follow if you are wondering how to invest in mutual funds online in India in 2023.

To invest online in mutual funds in India, you have to visit the website of the mutual fund house that you are aiming to invest in. Fill out the form with all the necessary details such as your email ID, name, email address, mobile number, bank details, and any other required information.

You may be asked to complete your KYC online. Enter your Aadhaar card and PAN card details to move further in the procedure. It will take some time for your information to be verified. After completing the verification procedure, you can start investing in the mutual fund you have chosen. The money gets directly transferred from your bank account to the mutual fund account.

Read on to find out how to invest in mutual funds easily through other online methods. Several online platforms offer help with mutual funds investments. You must create an account after filling in your details, and after the successful completion of the verification procedure, you will be able to transfer money from your bank account to the fund.

However, while going through the receipt years, make sure you check your investment objectives, the risk tolerance of the fund you are investing in, and other financial details before you start investing in a fund.

Investing in mutual funds online is the more feasible option as it can be done from the comfort of your home without stepping out even once.

How to Invest in Mutual Funds Offline?

If you often get puzzled about how to invest in direct mutual funds through offline methods, here is some important information you might not want to miss regarding the procedure.

When you want to invest in mutual funds through offline methods, you have to complete your KYC at KRA (KYC Registration Agency) by filling in all the necessary details required for the process.

You have to fill out an application form along with a cheque or bank draft after visiting your nearest bank branch or investor service centres of mutual funds before you start investing in mutual funds.

If you are a first-time investor who is wondering how to start investing in mutual funds, the safest option for you would be to visit your nearest branch office or the designated ISC to avoid any confusion or issue that may arise during the procedure.

According to your experience, and background, you need to decide whether you want to go for off-line or online methods to invest in mutual funds at your convenience.

Why Should you Opt for Mutual Funds in India?

There are several benefits that you can expect after investing in mutual funds in India in 2023. Even when you know how to invest in direct mutual funds, you should also look at the reasons you should do it. Some of the major benefits that you can enjoy are mentioned below.

- If you decide to invest in mutual funds in India, you have the option to choose to pay either a lump-sum amount at the beginning or you can also pay in instalments for a prolonged period. The flexibility of investing in mutual funds makes it one of India's most feasible investing options.

- You can start investing with Rs.500 as it is considered the lowest amount for most of the mutual funds out there in India. For those who are not comfortable investing a large amount initially, mutual funds can be the best option in today's world.

- If you invest in mutual funds, you become eligible to save the income tax rates from your interest rate. For instance, if you invest in ELSS funds in India, you can save up to 1.50,00,00 rupees per the 80 C income tax act of 1961.

- Most mutual funds do not have a lock-in period in India. On the other hand, if you invest in tax-saving fixed deposits, a five-year fixed lock-in period tends to be mandatory.

- Most mutual funds in India allow premature withdrawals of funds which is one of the most beneficial aspects of investing in mutual funds in India.

- You also have the option to shift your fund to another one of the same fund houses once you start investing in mutual funds.

- You can invest in mutual funds with specific goals in mind. Mutual funds tend to provide fund plans that end up helping the investors to meet all the financial goals that they have irrespective of the situation. Whether the goals are short-term or long-term, financial goals are easily met when you decide to invest in mutual funds instead of other fixed deposits in the country.

Things to Consider before Investing in Mutual Funds

Even when you know how to invest in mutual funds and why you should do it in today's world for a secured future, there are several things that you should keep in mind before investing in mutual funds in 2023. The major points that you should take a look at are mentioned below.

- Mutual funds come with several flexible options when it comes to investing. Mutual funds allow you to shift your fund from one fund to the other in the middle of the process. The fact that they allow SIP-based investment and lump-sum investments makes them a highly feasible option out there to invest in.

- The Rupee cost averaging phenomenon makes sure that your investment cost in the fund remains on the lower side. Therefore, the tendency of over-investing never takes place when you invest in mutual funds.

- ELSS and other schemes provide tax deductions that can go up to 1.50,00,00 per year as per the 80C provision act in India.

- Before investing in mutual funds or any fund in India, fix an investment goal and a budget for your future investments. It will help you analyse how much you can set aside for investing and give you an idea of the risk profile that comes with mutual funds.

- Even when you know how to invest in mutual funds and how to start investing in mutual funds, it is of utmost importance to consider that choosing the right kind of fund for your investments is necessary. Specifically, first-time Investors need to analyse risk factors and other issues before investing in mutual funds.

- If you withdraw your money from the period of six months to 12 months from the first investment date, a penalty will be charged in that case by the fund.

- Consider investing in several mutual funds to diversify your portfolio and on guaranteed returns.

FAQs

✅ Is it safe to make the investments in lump-sum or instalments?

It is always advisable to make your investments in systematic investment plans instead of lump-sum investments. A lump-sum investment is more likely to put you at the risk of hitting a stock market peak. Instalments allow you to make your investments over a prolonged period, which is always a less risky preposition from the financial perspective as the risk gets divided.

✅ Do I need a net banking account in order to make investments in mutual funds?

You must activate internet banking on your bank account if you want to invest in mutual funds in India. Mutual funds also allow you to make investments through your credit cards, debit cards and cheques.

✅ How do I invest in mutual funds without a broker?

You need to invest directly in a mutual fund either through online or offline methods through the access Management Company or AMC.

✅ How do I choose the proper fund to invest in?

You need to analyse the past performance of the fund. Also, go through the past performance of the fund manager, who manages most of the fund's work.

✅ Can I shift my money from one fund to the other after investing?

Yes. Mutual funds allow you to shift your fund from one fund to the other of the same fund house if you intend to, even after investing in one fund.