RBI Calls for Fifth Straight Repo Rate Cut; Home Loan EMIs to Go Down Further

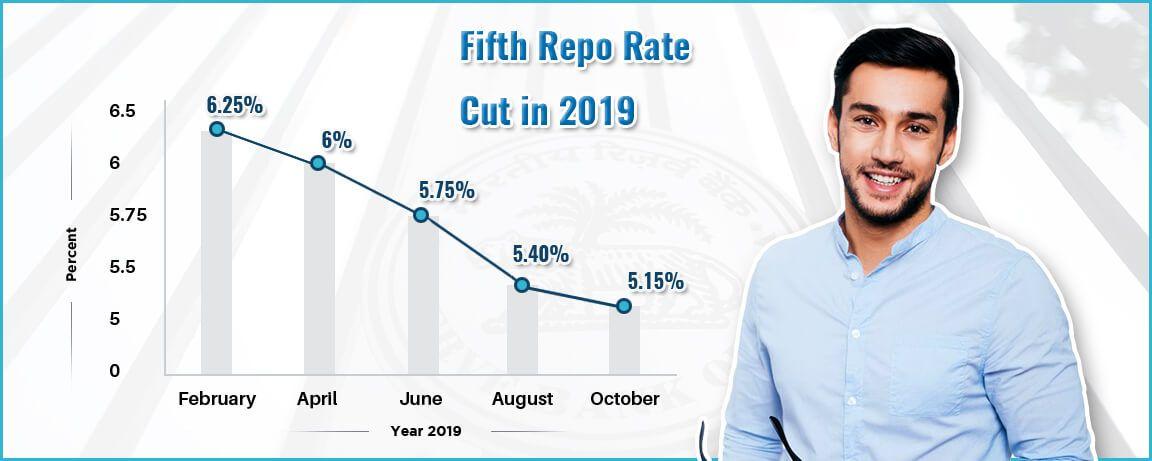

The Reserve Bank of India has announced a fifth straight cut in the repo rate at the bi-monthly monetary policy committee today. The revised repo rate now stands at 5.15 percent after a reduction of 25 bps.

Repo rate is the benchmark lending rate of RBI for banks, while the reverse repo rate is the rate at which the banks lend to the apex bank.

With the consecutive reduction in the benchmark lending rate by RBI, the cumulative repo rate cut is 135 bps. In the wake of banks adopting a repo rate linked lending rate for floating loans from 1st October 2019, the further rate cut ensures the consecutive lending rate cut for the borrowers.

This brings a cheer of more affordable loans to the customers ahead of the festival season. Whether you are planning to Apply for a Home Loan, LAP, MSME Loan, Car Loan, or any other Personal Loan on a floating basis, the sentiment is all set for more affordable loans.

Under the previous MCLR rate regime, the banks were reluctant to pass on the benefit of a reduced rate cut to the customers. But now onwards, we will witness faster interest rate cut transmission to the final customers.

RBI’s Directive on External Benchmarks

As per the guidelines from the Reserve Bank of India, issued on 4th September 2019, the floating interest rates for loans will now be linked to four external benchmarks. This guideline applies to all types of loans, including Personal Loan, Vehicle Loan, SME Loan, and Home Loan. Banks will now have to follow any of the below mentioned four benchmarks for setting the rate of interest charged on the loans:

- Repo Rate announced by the RBI periodically.

- Government of India three month treasury bill yield published by the Financial Benchmarks India Pvt. Ltd. (FBIL)

- Government of India six month treasury bill yield published by the Financial Benchmarks India Pvt. Ltd. (FBIL)

- Any other benchmark interest rate published by the Financial Benchmarks India Pvt. Ltd. (FBIL)

After this announcement, most Public Sector Banks have already announced linking of their Home Loans, Car Loans and other loans with the repo rate. Following lenders have already announced repo rate linked Home Loans:

- Bank of India

- SBI

- Central Bank of India

- Punjab National Bank

- Canara Bank

- Bank Of Baroda

- United Bank of India

- Federal Bank Ltd.

- Oriental Bank of Commerce

- Syndicate Bank

How repo rate linked loans will impact your EMI

Things are set for a radical shift. After the announcement from RBI, it was expected that the EMIs against all loans, including Home Loans, will fall substantially. As per experts, the interest rates applicable against Home Loans will fall by as much as 30 basis points.

For instance, the spread for the SBI Home Loan has been pegged at 2.65% over the base rate. With the repo rate presently being 5.40%, the interest rate for SBI Home Loan of up to Rs. 30 Lakhs will now be set against an external benchmark of 8.05%. This means that under the new system, the Home Loan interest rate from SBI will be effectively 8.20% as compared to present level of 8.30% floating interest rate under the MCLR linked system. Though, the bank can levy additional charges based on the profile of the customer.

Reset period for the EMI

In the same notification, RBI has issued additional instructions to the banks. Herein, the banks must reset the interest rate linked to any external benchmark, at least once every three months. Therefore, the interest rates against your Home Loan will now be revised within a period of three months. This will allow you to avail the benefits of any changes in external benchmarks within a period of three months. Do not get worried about how you will calculate your EMIs every three months. You can easily use the Home Loan EMI Calculator online to determine your EMIs within a few minutes.

The changes in the interest rates could be done more than once in three months. For, RBI has specified that it must be “at least once every three months,” there is no cap on the maximum number of changes.

Also, one more factor needs to be taken into consideration here. If the operating costs of the bank will increase, it can increase the spread charged on loan, but this can happen once every three years only as per the guidelines of RBI. So, there is no need to worry on this front.

From the above analysis, it is evident that unless your risk rating changes substantially, the benefits of repo rate cuts announced by RBI will be passed on to you in a time-bound manner.

To apply online for Best Credit Cards in India, Secured Loans and Unsecured Loans, visit mymoneymantra, the leading online lending marketplace that offers financial products from 90+ Banks and NBFCs. We have served 7 million+ happy customers since 1989.