What Does Your Loan Repayment History Say About Your Financial Health?

There are times when you may seek to borrow funds to meet personal goals such as sponsoring your child’s education, traveling to your favourite destination or managing some unexpected medical expenses. In such times, Personal Loans can come to your rescue. Not only does the credit allows you to use the disbursed amount on your accord, but also assures you of a quick approval period, in most cases.

A Personal Loan is unsecured credit and is offered solely on the basis of your age, income, and repayment history. If you are in the ideal age bracket of 21-60 years and you enjoy a steady source of income, the only thing that can possibly stand between you and the much-desired loan is your credit history, which is essentially gauged by a parameter called credit score. Like in case of most metrics, the higher your credit score, the better it makes you look on paper.

What is a Credit Score?

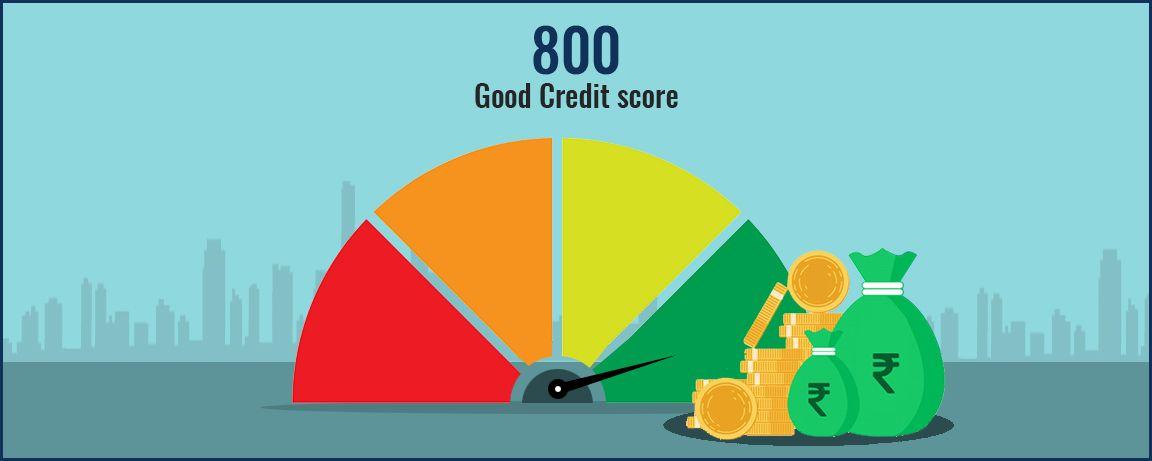

This score is primarily an indicator of your repayment behaviour over the past few years. It is offered in a three-digit numeric form ranging from 300 to 900. A score of 750 or above is considered excellent (for all loan and Credit Card categories) by the banks, a score of 500-700 is deemed to be reasonable (for secured credit), and a score lower than 500 is considered weak, and might harm your loan application adversely, even leading to its rejection. The credit score is maintained by independent credit bureaus like CIBIL, Experian, and so on. The score can easily be accessed by the banks and authorised lenders when they need to contemplate on your eligibility to avail the loan.

In order to have a high credit score, you must always pay your equated monthly instalments (EMIs), Credit Card bill and utility bills on time. Not only does it indicate that you are a responsible borrower, but also that your financial health is good enough that you don’t need to fall behind on these payments.

Needless to mention, banks love and prefer such reliable lenders, as they can rest assured of the fact that they will conveniently recover the loan amount along with interest.

At this point, it is essential for you to know, that not having a credit history at all, can also hurt your chances of getting a loan, as there will be no way for the banks to know if you are a responsible buyer. If you have a clean slate when it comes to a credit score, we recommend that you build one. This exercise can easily be undertaken by Applying for a Credit Card and maintaining a reasonable Credit Utilisation Ratio while paying all your Credit Card bills on time.

You can also opt for a small secured loan, such as a car loan. This loan will be easier to procure, even without a credit history, due to the collateral in the picture. Servicing the loan dutifully and paying your EMIs on time will help you build a good credit history.

Moreover, you can apply at a bank which enjoys a good rapport with the company you work for. This will mean that the bank will be willing to offer you a loan at comparatively lenient terms.

Building a score will make it much simpler for you to apply for a significant loan such as Personal Loan, car loan or even Home Loan.

Implications of a Poor Credit History

If your credit score is anywhere between 300 to 650 (or 750 in case of unsecured credit), it will mean the following for you:

- The banks may consider you an irresponsible borrower.

The lenders will come to the understanding that you suffer from a poor financial discipline and find it difficult to pay your bills and EMIs.

You may not be trusted when it comes to high-risk loans such as unsecured Personal Loans.

A low credit score can increase the chances of your loan application rejection.

In some instances, the banks may only agree to offer you credit at a somewhat higher interest rate. This, in the long run, may put a financial strain on you.

Advantages of a High Credit Score

If your score is 750 or above, you can expect it to benefit you in the following ways:

- The banks will view you as a responsible borrower.

- The lenders will conduct fewer checks when you apply for a loan.

You will enjoy higher chances of getting an approval on your loan application.

You can get a loan approved for an amount higher than your ideal credit limit.

You will stand a chance to get a loan on comparatively lower interest rates.

Tips to Improve Your Credit Score

Now that you have a fair idea of the significance of a good credit score let us take you through some simple tips which can help you pave your way to a respectable score.

Understand the pain points in your credit score. Check which aspects you fall behind on. If it is credit card payments, make sure to clear your bills, and stay on track in the coming times. If you have defaulted on EMI payments, take the requite measures to ensure that it doesn’t happen again.

If you have been applying for loans too frequently, make sure you rectify the damage done by staying low for a while, and not filing another application before a period of at least six months.

If you are currently servicing a loan, which is about to end, try and make all the payments in time. Once the loan tenure is over, take a break before applying for another loan. This will let the lenders know that you are not in a financial crunch, and can fund your day-to-day expenses on your own.

If you own one or more Credit Cards, make sure that you pay the bills well within time. Moreover, do not use your card, beyond 30% of your credit limit. Hence, if your credit limit is 50,000, make sure that your monthly spending using the card does not exceed 15,000. This will ensure the lenders that you are not credit-hungry and enjoy a respectable level of liquidity.

We hope that you are now better informed about the significance of the repayment history and what it conveys about your financial health. Take ample efforts to keep your financial health in good shape. Doing so will offer you easy access to different types of Personal Loans as and when required, making your life as convenient as possible!

Also Read: Do You Know That Personal Loan Tenure Can Impact Your Repayment Burden