Consolidate Your Debt for a Perfect Beginning of the New Year

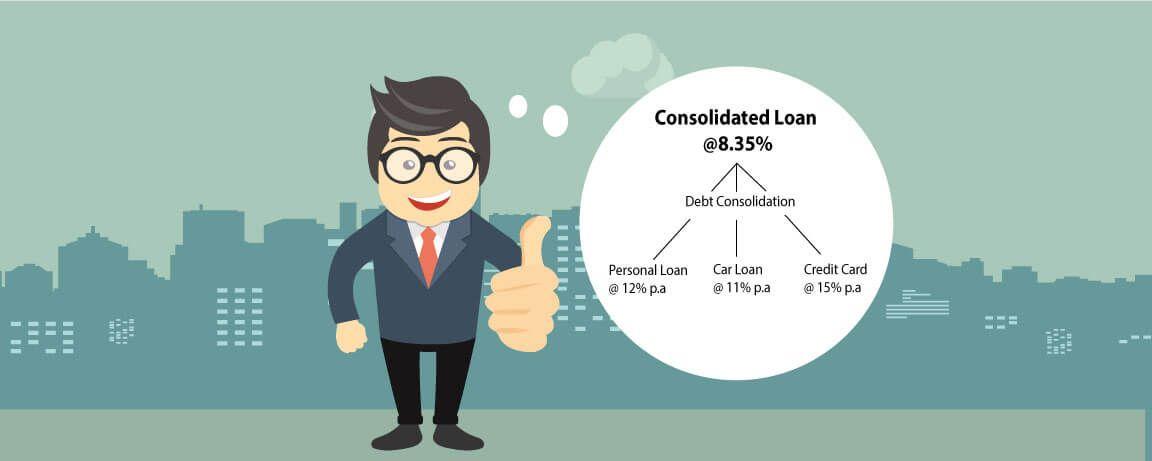

The New Year has arrived so are opportunities to have a close look at your finances. This New Year look for things to change your financial ways for the better. Are you paying multiple EMIs for different loans like personal loan, car loan, home loan, etc? So, festive expenses have taken a toll on your credit card bills too! How do you manage your debt with very little to spare for investments and your overall financial security? Debt consolidation is the answer. Consolidate your debt for a perfect beginning of the New Year.

Opt for a debt consolidation if:

- You have taken multiple loans

- Repayment tenure of your loan has been extended

- You have missed paying your EMIs

- Credit card bills are high

- You face difficulty in repaying loans

- There is stress on your wallet due to your debt, which may not be proportionate to your income.

How will consolidating your existing debt into a single loan benefit you? If the loan you choose for consolidating your debt comes at a low interest rate with longer tenure and other favorable terms and conditions, you gain a competitive advantage. No worrying about due dates of multiple EMIs! No hassles of tracking multiple EMIs! And the list of benefits goes on.

Consider the following factors when applying for a loan for debt consolidation:

1. Calculate your total outstanding debt. Calculate your existing investments. Subtract the first from the second. Consider applying for a loan of the balance amount.

2. Find out the best loan type that will well serve your borrowing purpose. Consider lower interest rates, long repayment tenure, etc. Credit options you choose may range from Personal Loan, loan against property to top up loan, loan against securities, etc.

3. When approving your loan, lenders will consider your credit scores. Check your credit report before applying for it. A credit report lets you know about your credit score, detect errors or frauds in your credit report and take required corrective actions.

Once you avail your loan for debt consolidation, prioritize on the following:

- Pay off your unsecured loans; this will help improve your credit mix

- Repay high interest loans

- Ensure regular repayment to avoid penalties and maintain a good credit score

- Ensure that EMI of your new loan gets automatically deducted so that you stay away from the hassles of remembering to pay your EMI on time

- Bump up the EMI with every rise in your income; this will help you repay your loan faster. Besides, you save big on interest rates.

A stable job in a good company may entitle you to benefits, especially big bonuses including income tax refunds. Besides if you are all set to receive maturity proceeds from bonds and life insurance policies, use the amount to pay your credit card bills. Bump up the EMI to close the debt faster. Visit a one-stop trusted online financial services marketplace that hosts all leading banks and their products. Using their easy-to-use tools you can compare interest rates on loan deals offered by various banks and apply in seconds. There can be no better gift for you than consolidating your debts this New Year.