What Documents Do I Need to Get a Personal Loan?

A personal loan can come in handy in more situations than you can possibly imagine. Right from helping you sponsor your child’s higher education to meet medical expenses, right from assisting you to pay for home renovation to arrange a wedding celebration, a personal loan can be used for a wide array of purposes, on your own accord.

Owing to the fact that it is an unsecured loan, and can be easily availed within a matter of 2-3 days or even less, this loan has gained unprecedented popularity over the past years.

If you are eyeing this loan to meet one or more financial obligations, it is best that you are well prepared, and have all the requisite documents for personal loan right under your sleeve. This will prove to be extremely helpful in getting your application processed at the earliest possible, while also helping you avail the disbursed amount in a hassle-free manner.

| Type of Documents | Salaried Individuals |

| Identity Proof | Any one of:

|

| Residence Proof | Any one of:

|

| Income Proof |

|

| Photographs |

|

| Type of Documents | Self-Employed Individuals |

| KYC Documents |

|

| Residence Proof | Any one of:

|

| Income Proof |

|

| Other Documents |

|

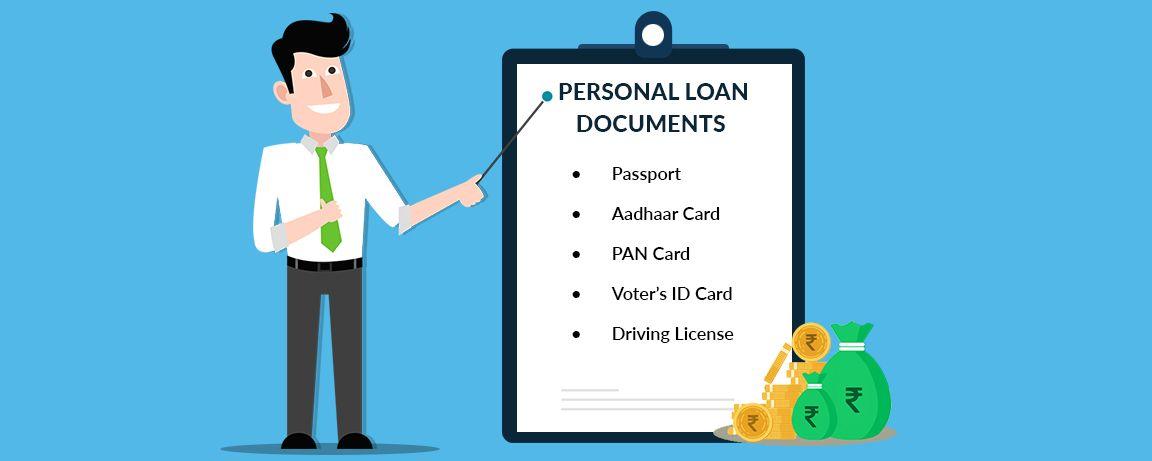

1. Proof of Identity

In India, a government-issued identity card, complete with a photo is considered to be the most reliable proof of identity. Anyone of the following documents can act as your identity proof;

- Passport

- Aadhaar Card

- PAN Card

- Voter’s ID Card

- Driving License

2. Proof of Residence

As is the case with identity proof, even proof of residence becomes most reliable, when it is issued by a government agency. As such, the below-mentioned documents prove to be ideal in this regard:

- Passport

- Ration Card

- Utility Bill

- Registered Rent Agreement

3. Proof of Ownership of Residence

To support your financial worth, it can prove to be in your favour if you can furnish documents indicating that you are an owner, a part owner or a co-owner of the house that you currently reside in. You can prove the same through any one of the following documents:

- Electricity Bill

- Property Documents

- Maintenance Bill

While it may not be mandatory for you to furnish the proof of ownership of residence, but it can surely help in convincing the bank of your strong financial foothold, especially if you are applying for a higher loan amount, say upwards of Rs. 10 Lakhs or for a Secured Personal Loan.

4. Proof of Office Address

This is only needed if you happen to be a business owner, or are a self-employed professional. In such cases, you can furnish any of the following documents to indicate your office address:

- Property Documents (if any)

- Maintenance Bill (if any)

- Utility Bill (Electricity/ Landline/ Water Bills)

5. Proof of Business Existence

As the title suggests, it is only essential for business owners to offer proof of the existence of their enterprise, and for self-employed professionals to prove that they have an on-going practice. This may be done through one of the following papers:

- Copies of Saral Form for the past 3 years

- Copy of the Shop Establishment Certificate

- Any Tax Registration Copy

- Company Registration License

6. Income Documents

As a salaried individual, you will need to prove that you enjoy a steady source of income from the organisation that you work for. This can be conveniently done by offering one of these:

- Salary slips for last 6 months

- Banks statement for the last three months

- Income Tax Returns for the last 2 years

- The latest copy of Form 16

As the owner of a business or a self-employed professional, you must be able to prove that you have been earning revenues from your business or practice for the past two years or more. To do so, you should furnish one or more of the following:

Income Tax Returns Statement for the last 2 years. This statement should be accompanied by the Computation of Income, Profit and Loss Account, Balance Sheet as well as an Audit Report.

Bank Statement for both currents as well as savings accounts for the last one year.

7. Proof of Investment

This will be only required if you hold any investments such as Fixed Assets, Fixed Deposit, Bonds and Shares among others. If you do, make sure you offer a proof of the same to the lender by furnishing the relevant documents. This will help the bank understand the fact that you plan your finances well, and are fairly disciplined, thus assuring them that you will repay your credit in a timely and systematic manner, without any defaults.

Besides the ones mentioned above, you should also be prepared with additional documents, which will be required at the time of processing your personal loan application. These include:

- One passport-sized photograph (in colour)

The sanction letter along with the payment track record, if you have an existing loan under your name.

Your professional degree certificate, if you are a self-employed professional, such as a doctor, lawyer, chartered accountant, and so on.

We hope that you now know the documents that you need to submit in order to enjoy quick and hassle-free processing of your loan application! So, wait no more before you arrange these personal loan documents, and file your application with your chosen lender. After all, your dreams shouldn’t have to wait any longer than they need to.