How to Pay HDFC Personal Loan EMI through Net Banking?

Table of Contents: [Hide]

- How to Pay HDFC Personal Loan EMI Online?

- How to Pay HDFC Personal Loan EMI through Netbanking?

- How to Pay HDFC Personal Loan EMI using Billdesk?

- How to Pay HDFC Personal Loan EMI using a Mobile application?

- How to Pay HDFC Personal Loan EMI Offline?

- How to Check HDFC Personal Loan Statement?

- HDFC Customer Care for Personal Loan Repayment Related Issues

- FAQs

How to Pay HDFC Bank Personal Loan EMI Online?

In today's digital world, everyone looks for a convenient & hassle-free way to make payments online so as to avoid visiting the branches, be it for any utility bill payment, credit card payments, mobile recharges or paying their EMI’s. So, if one chooses to pay Loan EMI Online, for that even there are many options so as to clear your dues conveniently. HDFC Website has been made very user friendly, and you can easily use it while making the payment of your personal loan EMI. Now let us know how to pay Loan EMI online and its different methods.

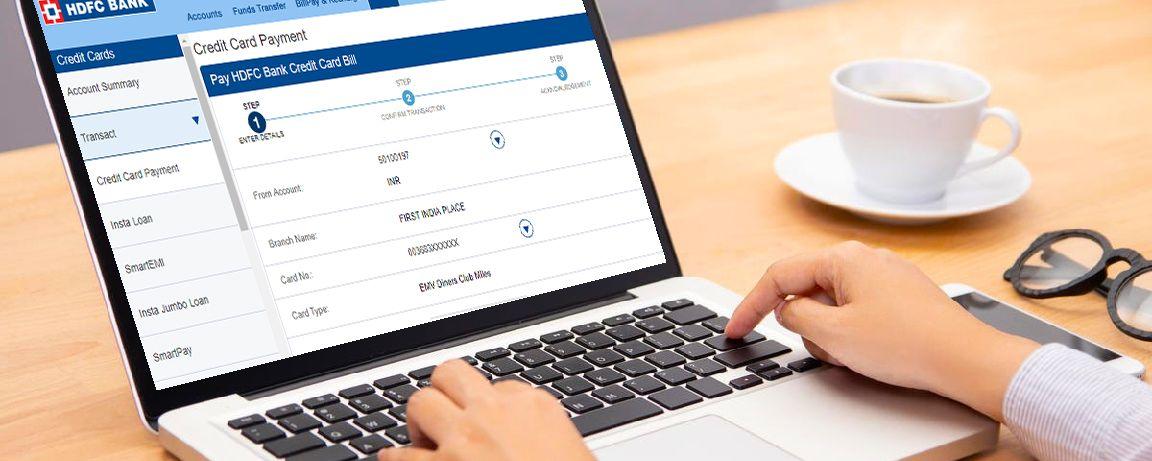

How to Pay HDFC Personal Loan EMI through Netbanking?

Payment of HDFC Personal Loan EMI through Netbanking is a very convenient method to clear dues, especially if you have authenticated auto-debit option, which means allowing the bank to debit the EMI Amount on a particular date of the month. Now let us know the steps for how to pay HDFC Personal Loan EMI through Netbanking:-

Step 1:- Enter the Customer ID and IPIN that you have created after opening the HDFC Login page on your PC or Laptop.

Step 2:- After clicking on "Continue" and enter the captcha, tick on the box "please confirm your secure access image", press Login.

Step 3:- Once that you have logged in, go to the Loan Tab & choose the personal loan for which you have to make payment.

Step 4:- Enter the EMI amount and make the payment finally.

Read Also: HDFC Overdraft Facility in detail.

How to Pay HDFC Personal Loan EMI using Billdesk?

While making payment of HDFC Personal Loan EMI via Billdesk, there's no such requirement of having a Bank account with HDFC Bank. You can have an account with any bank to make payment of HDFC Personal Loan EMI.

Step 1:- Enter your Loan Number

Step 2:- Then enter your date of birth, which should be as per your Bank records.

Step 3:- After entering these details, one can make an EMI payment easily.

How to Pay HDFC Personal Loan EMI using a Mobile application?

HDFC Bank App is easily available on all Android & IOS Devices, i.e. on Google Play Store and Apple Play Store, respectively. Once you Log In by entering your Customer ID and password, go to the Payment Tab, and click on Personal Loan to pay Personal Loan EMI.

Other HDFC Personal Loan Online Payment Options:

HDFC Bank Personal Loan customers can also pay their EMI’s via:-

Paytm

Paytm offers a wide range of services, one of which is Loan EMI payment. Below mentioned are the steps to make payment of HDFC personal Loan EMI via Paytm:-

Step 1:- Go to the Loan repayment Tab on Paytm.

Step 2:- Choose HDFC Bank from the list of Banks available.

Step 3:- Enter your Loan Number and click on “Get Payable Amount”.

Step 4:- Then, finally make the payment by choosing the preferable mode of payment.

NEFT/ RTGS

For making HDFC Personal Loan payment, NEFT / RTGS option can also be availed, but for that, one needs to have Bank Account in any other Bank apart from HDFC Bank.

How to Pay HDFC Personal Loan EMI Offline?

Cash

One can repay the entire loan in cash, provided each instalment is less than Rs 2 Lakh, which means that one can repay the Loan EMI amount in cash if it is less than 2 lakhs.

Cheque/Draft

For making payment of HDFC Bank personal loan EMI, the option of Cheques and drafts can also be used. They should be drawn in favour of HDFC Bank.

Standing Instruction/NACH Mandate

Nowadays, there’s a method that is in demand, i.e. making automatic EMI payment directly from your bank account by giving the Standing Instruction (SI) or National Automated Clearing House (NACH) mandate. One can do this by filling a form and then submitting it to the bank. It will enable the bank to auto to deduct EMI from the HDFC Bank or any other bank account on the due date. Also, one can register for the e-NACH mandate option of which is available on the HDFC Bank Website.

How to check HDFC Personal loan statement?

In order to check the HDFC Personal Loan statement, one needs to follow the below-mentioned steps:-

Step 1:- Log in to HDFC NetBanking

Step 2:- Go to the Loan Tabs and then select ‘Register New Loan’.

Step 3:- Enter the details as asked and Click on ‘submit’.

Step 4:- Once you receive an OTP on your registered mobile number, enter it to complete the registration process.

HDFC Customer Care for Personal Loan Repayment Related Issues

For any queries, issues or complaints with respect to personal loans and their repayments, one can contact the bank's customer care department between 8.00 am and 8.00 pm on all days (including Sundays). Below mentioned are the HDFC Bank Personal Loan customer care phone numbers for various cities:

| City | HDFC Personal Loan Customer Care Number |

| Ahmedabad | (079)61606161 |

| Bangalore | (080)61606161 |

| Chandigarh | (0172)6160616 |

| Chennai | (044)61606161 |

| Cochin | (0484)6160616 |

| Delhi and NCR | (011)61606161 |

| Hyderabad | (040)61606161 |

| Indore | (0731)6160616 |

| Jaipur | (0141)6160616 |

| Kolkata | (033)61606161 |

| Lucknow | (0522)6160616 |

| Mumbai | (022)61606161 |

| Pune | (020)61606161 |

Frequently Asked Questions (FAQs)

✅ HDFC Loan EMI through UPI?

Yes, you can opt for the HDFC Loan Payment Online UPI method for HDFC loan EMI payment.

✅ When can I close my HDFC Personal LoanCan we pay?

HDFC Bank usually does not allow complete closure of a personal loan in advance. However, it allows us to make part payment of the loan, which can be done at least 12 months after the first EMI & cannot exceed 25 per cent of the total principal outstanding.

✅ What if the personal loan EMI is not paid on the due date?

Failing to pay EMI on the due date adversely affects the credit score. Also, the bank will charge penal interest at the rate of 2% per month on the outstanding principal amount till the time payment is made.

✅ What about the charges if payment is not made on time?

Late payment of EMI on Personal Loan will attract Late Payment Charges which are as follows:

- Overdue EMI interest: 2% of the loan principal amount overdue per month

- Cheque Bounce Charges: Rs. 550 per instance of cheque bounce

✅ Is it possible to cancel the loan?

- After visiting a bank, one needs to fill a form or write a letter requesting pre-closure of the Personal Loan account in order to cancel the loan taken.

- Pay the pre-closure amount after signing the required documents, if any.

- Take acknowledgement of the payment being made.