10 Credit Card Privileges You Must Know About

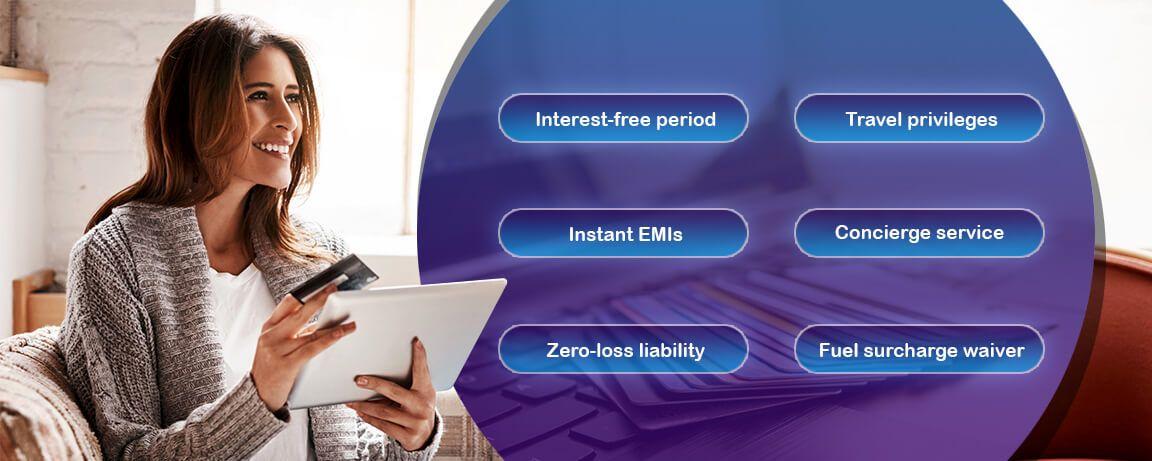

Credit Cards are amongst the most feature-rich financial products available in the present market. Apart from the usual benefit of offering instant access to credit for financing your purchases, the plastic card offers you numerous privileges as a cardholder.

Disciplined use of Credit Cards can indeed add immense value to your lifestyle.

Here are 10 Credit Card privileges you must know about:

1. Interest-free period:

All Credit Cards come with an interest-free period ranging between 20-50 days. So, when you repay the card balance within this free credit period, you need not pay any interest on the transaction made. This means that by planning and timing your purchases, you can enjoy an interest-free period of up to 50 days with your plastic. This can indeed result in significant savings each month.

2. Travel privileges:

Certain Credit Cards come with useful travel privileges, that can help you enjoy the ultimate travel experience. Free Airport Lounge access, complimentary Air tickets, discounted food & beverages, offers on travel bookings, complimentary travel insurance, free emergency travel assistance, attractive cashback offers, low forex mark-up fee are some of the travel privileges that come along your Credit Card! For instance, certain SBI Credit Cards offer you free Airport Lounge access in India as well as abroad.

3. Instant EMIs:

You can convert your big-ticket purchases into affordable EMIs with your Credit Card. This allows you the flexibility to purchase the products that you desire at your convenience, wherein you get an option to repay within easy EMIs for up to 36 months. This facility is available for transactions with select online as well as retail vendors. During special promotions, merchants offer the facility of interest-free EMIs, wherein you only need to pay the principal amount over the repayment tenor. Moreover, you need not have to manage a separate loan account as the EMIs are added to your monthly Credit Card statement and must be paid along with the credit card bill.

4. Concierge service:

When you are an elite customer holding any of the premium Credit Cards, you enjoy certain amazing privileges. One such privilege is the concierge service. Whatever may be the task you need help with, the concierge service will take care of it for you. Party planning, travel booking, handling special tasks, or any other special requirements that you may have, the concierge service will handle it for you. The maximum number of times you can avail of this service depends on the Credit Card you own.

5. Free life insurance/ accident insurance cover:

Many Credit Cardholders do not know this, but most cards come with free life insurance, travel insurance, and accident insurance coverage. This coverage offers you protection against unwanted happenings and also eliminates the need to purchase separate insurance policies every year. These policies are renewed every year with your Credit Card and offer you comprehensive protection against mishappening, saving substantial money towards premium payments.

6. Zero-loss liability:

Offering you protection in case of loss of your Credit Card, the zero-loss liability cover saves you from unwanted losses on account of the issue of your Credit Card. Though, in order to activate this cover, you must intimate the issuer regarding the loss of your Credit Card. Once you have informed the loss of the card, you are protected against any card misuse thereafter. This cover is available even if you are travelling to an international location.

7. Waiver of joining fee/ annual fee:

When you avail of a Credit Card, you need to pay a joining fee and then an annual fee every year for renewal. But do you know that by spending a certain amount within a few days of receiving a Credit Card and then by having a total spend of above a specific threshold, you can get a complete waiver of joining fee and annual fee, respectively?

Moreover, there are Credit Cards that do not carry any joining fee or renewal expenses. For instance, there are Lifetime Free SBI Credit Cards such as SBI Card Unnati, which is free for the first four years, and then you get a waiver of annual fee on achieving milestone usage threshold.

8. Fuel surcharge waiver:

One of the most frequent uses of Credit Cards by customers is for the payment of fuel refilling. By transacting through your Credit Cards, you can enjoy a fuel surcharge of 1%. This waiver is credited directly to your credit card account. Though there are certain limitations to this waiver, i.e., the transaction must be above a specified amount, and the total waiver that can be received in a month is also capped. If your card qualifies for fuel benefits, you must certainly make use of free fuel each month.

9. Reward points Redemption:

All Credit Cards come with a reward points redemption program wherein you can redeem your reward points for buying various products and gift vouchers. The rewards available depend on the type of Credit Card you are using and the points that you have accumulated. Moreover, certain cards allow you to redeem reward points for Air Ticket bookings and hotel reservations. You can also convert the reward points into cashback to your Credit Card account. Though, reward points come with a specified expiry date and, therefore, must be redeemed before they expire.

10. Instant Personal Loans:

Your card also qualifies you for Instant Personal Loan Against Credit Card. These loans are offered on a pre-approved basis and, therefore, can be availed within a very short span. The facility is offered by creating a separate loan account, and the loan amount offered is over and above your Credit Card limit. To enjoy this facility, you need to get in touch with the Customer Care helpline or log-on to your internet banking account.

With such interesting privileges on offer, the user-experience with Credit Cards in India is set to reach the next level. But do remember to exercise financial discipline while using plastic for your expenses.

Also Read: Best Lifetime Free Credit Cards in India