Maintain a Healthy Credit Score

Owing to the Prime Minister Narendra Modi’s encouragement toward a cashless economy in the past few years, today, there are a whopping 3.62 Crore people in India who hold a Credit Card. Though most credit cardholders are aware of the benefits of these cards, they rarely know the significance of maintaining a good credit history or building their credit score. If you happen to be one of the millennial, who either wants to Apply for a Credit Card or has just received one, it is highly recommended for you to understand the importance of credit score. Only once you do that, will it be of any use for you to know how to build and maintain a healthy rating. So, without further ado, let’s get started.

Credit History

Credit history can be essentially defined as an elaborate account of your credit borrowings as well as their repayments. Every time you borrow money in the form of a loan, or simply make use of your Credit Card, the details of the same get recorded with your bank. If you make the repayments well within the stipulated time, it has a positive impact on your history and vice versa.

Since you may have accounts in more than one bank, and may even approach a new bank altogether for new credit, there are centralised credit bureaus which maintain your credit reports. All banks are required to send your monthly credit history to these bureaus, which maintain a detailed summary of the same. Hence, when you approach a bank or non-banking financial company (NBFC) for borrowing some money, they will contact the credit bureaus to see if you are a responsible borrower. Only if your repayment history looks good enough, will they lend you any money!

Credit Score

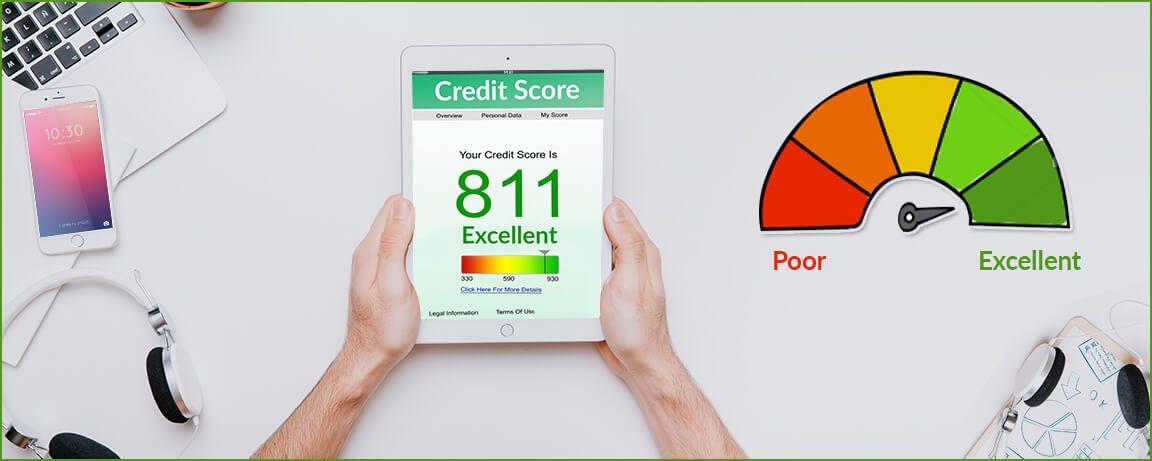

Depending on how you manage your bank accounts, borrowings as well as repayments, credit bureaus rate you on a scale of 300 to 900. A score ranging from 750 to 900 is considered excellent, while that between 550 and 750 is deemed to be average. A score below 550 is considered very poor. Needless to say, the better your score, the more willing will the bank be to offer you a loan. If, however, your score is rather low, your loan application may not be approved. The reason behind this is simple. If you have always paid your bills as well as your equated monthly instalment (EMIs) on time, the bank is more likely to believe in your ability and willingness to repay the loan in the coming future. If, on the other hand, you have been lousy with respect to repaying your credit, the bank may see you as a potentially risky client, and would, therefore, shy away from lending you money.

As you must have come to understand by now, maintaining a high Credit Score is not an option but a compulsion, if you want to enjoy access to loans and other forms of credit in the near future. Considering that you are new to the concept, let us also tell you that having a good credit history not only helps you gain access to low-cost loans but also ensures that you enjoy affordable premiums when you opt for various types of insurance. Moreover, it helps you in day-to-day endeavours such as getting an apartment on rent, acquiring a job with a reputable Organisation, and even getting a cell-phone, cable or gas connection.

Tips to Maintain a Healthy Credit Score

Now that you are aware of the significance of a good credit score let us tell you how to maintain it.

1. Make Timely Payments

In order to come off as a responsible borrower, it is imperative that you pay your EMIs as well as Credit Card bills on time. Please note that a single late payment can cost you as much as 100 points, thus giving a blow to your score almost instantaneously. Hence, it is recommended that you always set aside the money required to make these payments. Moreover, you can choose the alternative for autopay to avoid missing or forgetting the payment dates.

2. Use Your Credit Card Judiciously

Getting a credit card today is far more comfortable than it used to be. However, that doesn’t necessarily mean that you can, or you should exploit the same. Exhausting your Credit Card limit every month, or simply paying the minimum due amount while carrying forward the rest may not only harm your credit score but can also lead you into a debt trap. Hence, you must make sure that you pay all your Credit Card bills in full, every single month. A great way to make sure that you don’t forget about the due date is to set mobile alerts or email notifications for the same!

Then again, it is a good practice to spend only up to 30% of your credit limit. For instance, if your credit limit is 50,000 per month, you should not spend more than 15,000 using the card. This indicates to the bank and the credit bureaus, that you have your finances in control, and that you are not overly dependent on credit for managing your day-to-day expenses.

3. Pay Your Utility Bills on Time

This is one of the most convenient measures that can help your credit history look good. Considering the fact that almost 35% of your credit score depends on your bill payment history, you must make sure that you pay all your utility bills such as that for electricity, water, gas, telephone and mobile phone connections on time. If you are unsure that you will be able to remember the due dates, make use of an autopay service that helps you take care of the same.

We hope that you are now better informed about the significance of maintaining a good credit score, as well as the ways to do so! With that being done, you are now all prepped up to apply for a Credit Card and enjoy the myriad of benefits of the same!

To apply online for Credit Cards, Secured Loans and Unsecured Loans, visit www.mymoneymantra.com, the leading online lending marketplace that offers financial products from 70+ Banks and NBFCs. We have served 2 million+ happy customers since 1989.