How to Close HDFC Credit Card? - A Step by Step Guide

Nowadays, closing, cancelling, or deactivating a Credit card has been made as easy as applying for the same. Banks like HDFC Bank allow their existing credit cardholders to cancel or close their same easily at their own will. Let's now understand how to close HDFC credit cards online and offline at our convenience.

Table of Contents:

- Different ways to Close HDFC Credit Card

- How to close an HDFC Credit card by filling the form?

- How to close HDFC Credit Card temporarily in case of fraudulent activity?

- How to close HDFC credit card using Net Banking?

- How to close HDFC credit card using Mobile Banking?

- How to close HDFC credit card using Phone Banking?

- Things to Keep Handy before Calling Phone Banking to Report Unauthorised Transaction

- Does a Cancelled or Closed HDFC Credit Card affect your CIBIL Score?

- How to Reactivate a Deactivated HDFC Bank Credit Card?

- FAQs

Different ways to Close, Cancel, or Deactivate HDFC Credit Card

How to close an HDFC Credit card by calling Customer Care?

HDFC Customer Care Service lets its customers close or cancel their credit cards whenever they want by calling the toll-free number "61606161", which is 24x7 available. Customers can easily get their queries resolved by calling this number.

HDFC Bank provides city-specific customer care numbers as well for the convenience of its users. Below mentioned are the HDFC Bank customer care numbers for specific cities along with city codes:-

| HDFC Bank Customer Care Numbers | |

| Ahmedabad | 079 61606161 |

| Bangalore | 080 61606161 |

| Chandigarh | 0172 6160616 |

| Chennai | 044 61606161 |

| Cochin | 0484 6160616 |

| Delhi & NCR | 011 61606161 |

| Hyderabad | 040 61606161 |

| Indore | 0731 6160616 |

| Jaipur | 0141 6160616 |

| Kolkata | 033 61606161 |

| Lucknow | 0522 6160616 |

| Mumbai | 022 61606161 |

| Pune | 020 61606161 |

Note: You might be charged for calling as per your tariff plan with the service provider

For any other city that is not mentioned above, customers can visit this link.

How to close an HDFC Credit card by filling out the form?

The following are the steps for closing an HDFC credit card by filling out an application form:-

Step 1: Firstly, the HDFC credit card closure form should be downloaded from this link.

Step 2: Next, one should fill out the form and then send it to the address.

HDFC Bank Cards Division,

P.O.Box No.8654, Thiruvanmiyur P.O.

Chennai – 600 041

After the initiation of cancellation of the credit card, it should be cut diagonally by the cardholder. Also, cancellation or closure of primary credit cards would result in cancellation or closure of add-on credit cards as well, i.e., they would be terminated automatically.

How to close an HDFC Credit Card temporarily in case of fraudulent activity?

After realising that either fraud has occurred on your card or any unauthorised transaction has been made, you should immediately inform your respective bank at the earliest.

In the case of HDFC Bank, the following are the different methods available through which one can get their card blocked in case of fraud.

How to close an HDFC credit card using Net Banking?

Following are some of the simple steps, using which you can get your credit card blocked using net banking:-

- Step 1:- At first, simply log in to the HDFC Website by clicking on- https://netbanking.hdfcbank.com/netbanking/.

- Step 2:- Enter your customer ID & your password.

- Step 3:- Once you are logged in, go to the "Card" Tab.

- Step 4:- Then, under the Credit Card Section, go to "Request".

- Step 5:- After clicking on Credit Card Hotlisting, your bank will block your card.

How to close an HDFC credit card using Mobile Banking?

Following are some of the simple steps, using which you can get your credit card blocked using mobile banking:-

- Step 1:- To block your credit card by using mobile banking, at first, you need to have the HDFC mobile banking app on your device that can be simply downloaded from App Store/ Play Store by IOS/Android users, respectively.

- Step 2:- You can either use a 4-digit PIN to log in, or you can use Touch ID as well for the same.

- Step 3:- Go to "Menu", then click on "Pay", and after that, go to the "Cards" section.

- Step 4:- Select the credit card from the list of cards that you need to block because of fraudulent activity being done on that card.

- Step 5:- To get the card closed or blocked, click on the "Block" option after providing the reason for the same, which can be lost or stolen.

- Step 6: Once the card is blocked, you can even opt for the re-issuance of a credit card through Mobile banking only.

How to close an HDFC credit card using Phone Banking?

In case of fraudulent activity on your HDFC credit card, you can get it closed by making a call to your phone banking number to report the fraudulent activity. The customer care number will depend on the city or country in which you reside, details of which can be obtained from HDFC's official website.

One can also call 18002586161 to report the fraudulent activity or to get the credit card blocked. Once it is blocked, the bank can be asked for the reissuance of a new credit card.

Things to Keep Handy before Calling Phone Banking to Report Unauthorised Transactions

Once you have decided to make a call to the customer care number to report the fraud, you need to keep the following information ready.

- Credit Card

- The type of transaction, i.e., whether it was used to make an online transaction or what

- The date on which the fraudulent transaction occurred

- And the number of transactions

HDFC Phone Banking Number in case of NRIs:-

| Country | Phone Banking Number |

| United States of America | 855-999-6061 |

| Singapore | 800-101-2850 |

| Canada | 855-999-6061 |

| Other countries | 91-2267606161 |

Things to Keep in Mind While Closing an HDFC Credit Card

Many times, customer feels it is very fussy to manage credit cards, or sometimes they get a better option, i.e., better offers from some other bank which suits their financial requirements in a better manner, due to which a need arises to close or cancel a current credit card. So, it is of extreme importance for you to know the process of closing or deactivating an HDFC credit card or any other bank credit card.

Let's now have a look at some of the key points to consider before knowing how to close an HDFC credit card online or offline:

- Payment of Dues: Once the cardholders have applied for closure or cancellation of the credit card, they should make sure that all the outstanding amounts or dues, or unpaid EMIs against the respective credit card, if any, are cleared. If not cleared or paid, then they would be notified by the bank either through a call or through an email on their registered phone number or email ID, respectively.

- Reward Points Redemption: The cardholders should check the number of reward points that are standing unredeemed before applying for the cancellation of a credit card. They can use the same to buy attractive products, to get lucrative discounts on the products and services that are available in the bank’s rewards catalogue.

- Assure non-usage of the credit card just before cancellation: The credit cardholder should be well aware of the fact that if they use the credit card just before closing it, then the request for closure or cancellation would not be taken up by the bank. It would only be considered if all the dues are cleared by the cardholder.

- Scrutinise the latest credit card statement for fraudulent activity: Credit cardholders should rigorously scrutinise the latest credit card statement before applying for the cancellation of their credit card to ensure that no fraudulent transactions have been made.

Consequences of closing the credit card

Suppose we speak about the overall credit limit, which would get reduced if one of the cards is cancelled or closed. As a result of which there would be an increase in the utilisation of the credit limit if expenses remain the same. This would end up adversely affecting the credit score and also getting loan approval.

Does a cancelled or Closed HDFC Credit Card affect your CIBIL Score?

The answer to the question is yes, but only if the credit cardholder uses more than one credit card. As explained above, cancellation of one of the credit cards would result in a reduction of the overall credit limit, but simultaneously an increase in the utilisation of the credit limit. So, in this way, cancellation or closure of credit cards would adversely affect the CIBIL score.

How to Reactivate a Deactivated HDFC Bank Credit Card?

Below mentioned are the steps for reactivating a deactivated HDFC Bank credit card:-

Step 1:- The application form should be downloaded from HDFC's official website, i.e., www.hdfcbank.com, if the cardholder wants to reactivate the closed credit card.

Step 2:- After filling it out, it should be sent to the address.

HDFC Bank Cards Division, PO Box 8654, Thiruvanmiyur, Chennai-600041

Step 3: Upon successful verification of the same, the bank would reactivate the credit card.

Frequently Asked Questions (FAQs)

✅ Difference between HDFC Credit & Debit Card

The difference between debit & credit cards is that the debit card balance is deducted immediately at the time of the transaction, but in credit card balance is deducted from the pre-approved limit, and the cardholder is allowed to make their payment over a period of time that is fixed in advance, along with interest.

✅How can I close my HDFC credit card online?

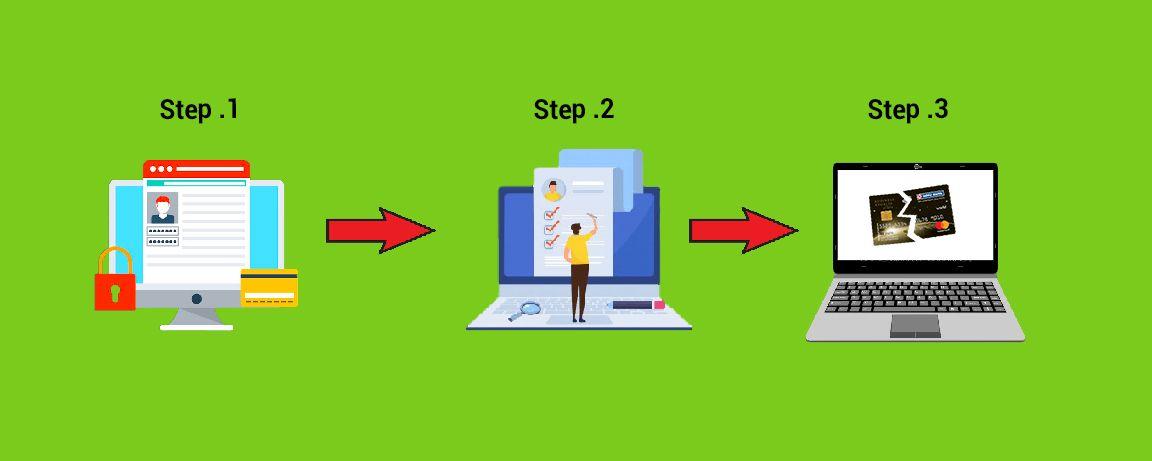

Below mentioned are the steps for the same:-

Step 1:- Log in to your HDFC account and go to the Credit Card Section.

Step 2: Next, click on Credit Card Hotlisting.

Step 3:- Select a credit card from the list of all credit cards that need to be closed.

Step 4: Once the reason for closure is shown, it would make the card non-operational and would be closed.