Step-by-Step Guide to Increasing Limit on Your Credit Card

Credit Cards bring along multiple benefits. You not only enjoy 30 to 50 days of free credit period but also the ultimate freedom to make a big purchase without bothering about the availability of cash in your wallet. Besides, well-managed Credit Card spendings can help you build your score.

Each Credit Card you own comes with a pre-defined Credit limit. In most cases, credit limit ranges from 1.5 to 3 times of your net monthly income. Having a high credit limit can help you maintain optimum Credit Utilisation Ratio and credit score effortlessly. Besides, the credit limit also comes in handy during emergencies.

How does a Credit Card issuing company calculate your Credit Card limit? A card issuer will assess your Credit Card limit based on several factors, such as your monthly income, loan history, relationship with the Credit Card provider, past spending behaviour, and your employment status.

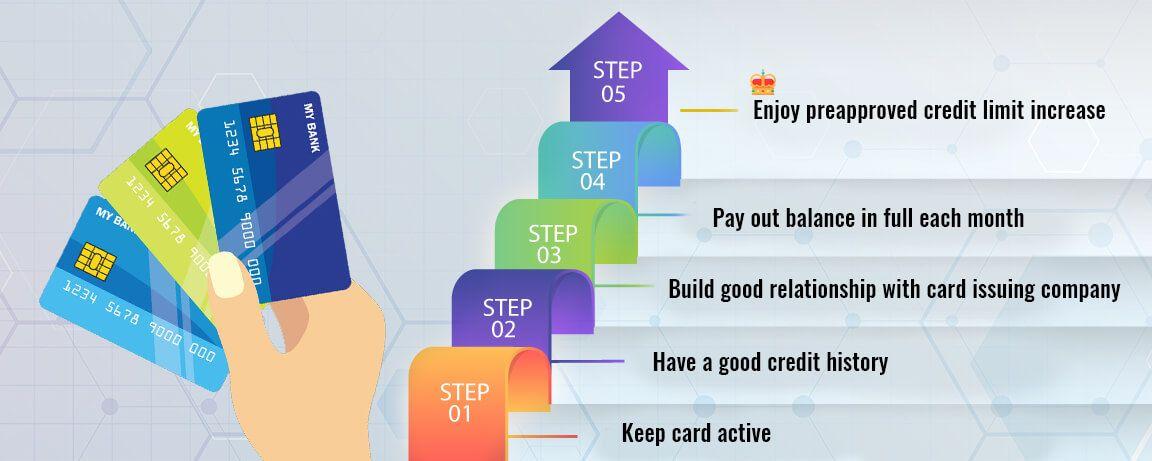

If you wish to enhance your credit limit, here’s a quick guide to help you achieve your goal.

Request Your Card Provider to Raise your Credit Limit

One of the simplest ways to improve your Credit Card limit is by requesting your existing Card provider. You can either contact the respective customer care service with your request or physically visit your nearest branch. In most cases, you can expect a 10 to 25% increase in your credit limit. Of course, you need to remember that your provider will only pay heed to your request if you enjoy a fairly high credit score, and have proven to be a responsible borrower in the past. Here, habits like clearing your Credit Card bills in time, always paying more than the minimum balance, maintaining a low Credit Utilisation Ratio, etc. will work in your favour.

Furthermore, it is crucial to understand that you should only place such a request for one Credit Card at a time. Simultaneously asking for credit limit extension on multiple Cards such as HDFC Credit Card and Citi Bank Credit Card will make you appear credit hungry to the card companies. Credit Bureaus will take a note of this behaviour, which will consequently get reflected in your repayment history.

Have a Consistent Approach

If you believe that you’re a good candidate for a credit limit increase, make sure to convey the same to the customer care executive you are speaking to. Reasons such as the ones mentioned below will help you prove your point:

- You are a loyal customer of the bank

- You are punctual with your monthly Credit Card payments

- You ensure that your payments always exceed the minimum balance

- Your CUR is less than 30%

- Your income has increased due to a recent promotion/ employment hike

- You have added a secondary source of income over the years

Having a consistent approach helps. However, make sure that you don’t come off as too desperate for the increase in the credit limit. It is important to maintain a friendly tone with the customer care representative so that they take up your request earnestly.

Ask for a Reasonable Increase in the Limit

When you call the customer care for an increase in credit limit expect a fair rise up to 25%. Whether you have an SBI Credit Card or any other, only your relationship with the Credit Card Company can help you get a higher raise. The decision would be solely based on the credit policy of the card company.

If you get a significant raise in your credit limit, make sure that you don’t get enticed by the same and start overspending. Remember, an increase in credit limit is different than an increase in your ability to pay bills.

Try Opting for a Balance Transfer

If your current Credit Card provider is not inclined to raise your credit limit, you can approach an alternative Credit Card provider to transfer your balance from the existing card to the new card along with an enhanced credit limit. Most Credit Card companies are willing to offer a seamless balance transfer facility, as it helps them get new customers on board without much effort. Besides, in some cases, companies also charge a balance transfer fee, which adds to their profitability.

While this can said to be a smart financial move, you must weigh the benefits of Balance Transfer and increased Credit Limit against the Balance Transfer fee and make the call accordingly.

Wait Your Time

In a vast majority of cases, Credit Card providers review their customers’ accounts at least once every six months or so. As a part of this review, customers in good standings are picked out and rewarded with a pre-approved limit increase. If you’ve been a good customer with a high level of financial discipline, it might be in your interest to wait and watch before requesting an increase from your end.

Now that you know what works best to increase the credit limit go ahead and make the right move. After all, no one knows your credit behavior and your relationship quotient with your Credit Card provider, better than you!

Also Read: 5 Ways Your Credit Card can Help You during Emergency

To apply online forBest Credit Cards in India, Secured Loans and Unsecured Loans, visit MyMoneyMantra, the leading online lending marketplace that offers financial products from 100+ Banks and NBFCs. We have served 7 million+ happy customers since 1989.